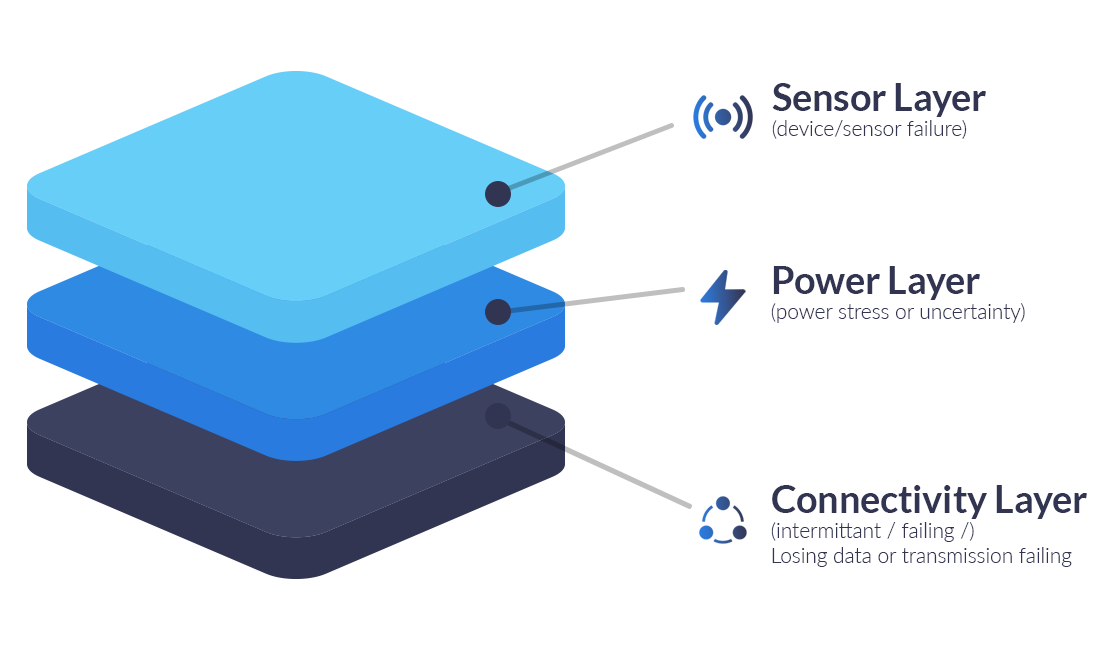

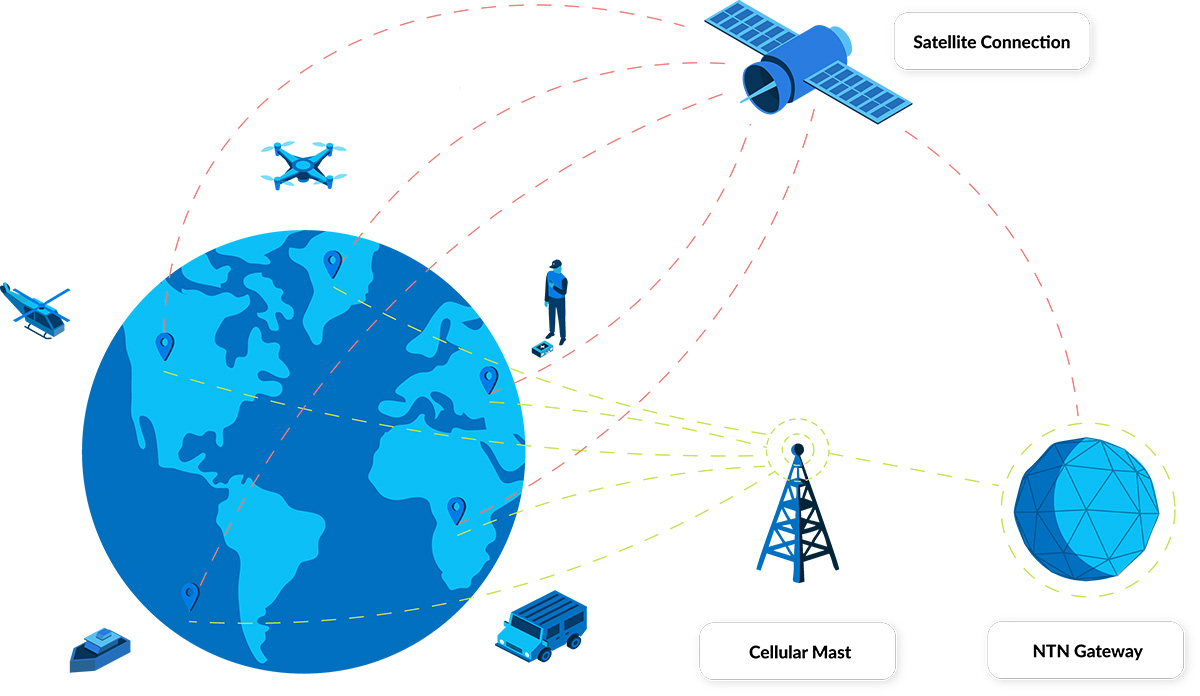

Remote IoT looks straightforward until you hit the realities of variable latency, tight data budgets, and devices you can’t easily reach once deployed.

This free and ungated eBook distills the integration pitfalls Ground Control sees most often, plus the practical patterns that help teams go live faster and stay operational long after launch.

It’s written for IoT product and platform teams, systems integrators and solution architects, operations and field deployment leaders, and security/IT stakeholders supporting remote infrastructure.

What’s Inside: The Six Costliest Integration Mistakes

1. Security & IT Reality Checks

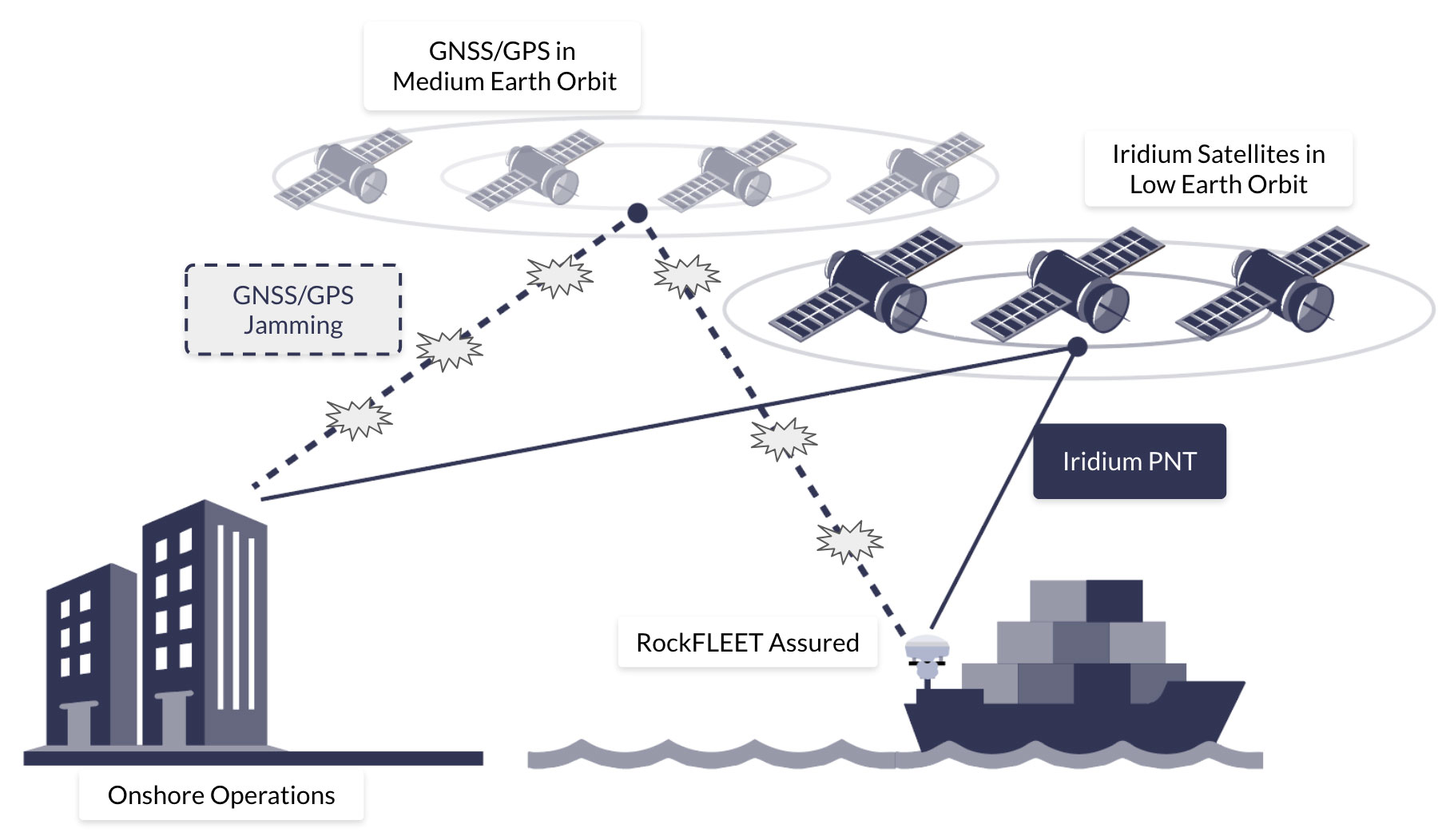

Satellite links can be strongly encrypted, but risk often concentrates at the handoffs, where data routes from the ground segment into your cloud / application environment.

The eBook outlines common postures (VPN + firewalls, private circuits, or higher-isolation architectures) and the blockers that derail projects late.

Fast takeaway: map the end to end path, choose the security posture deliberately, define ownership, and pre-empt IP range conflicts/timeouts before they become downtime.

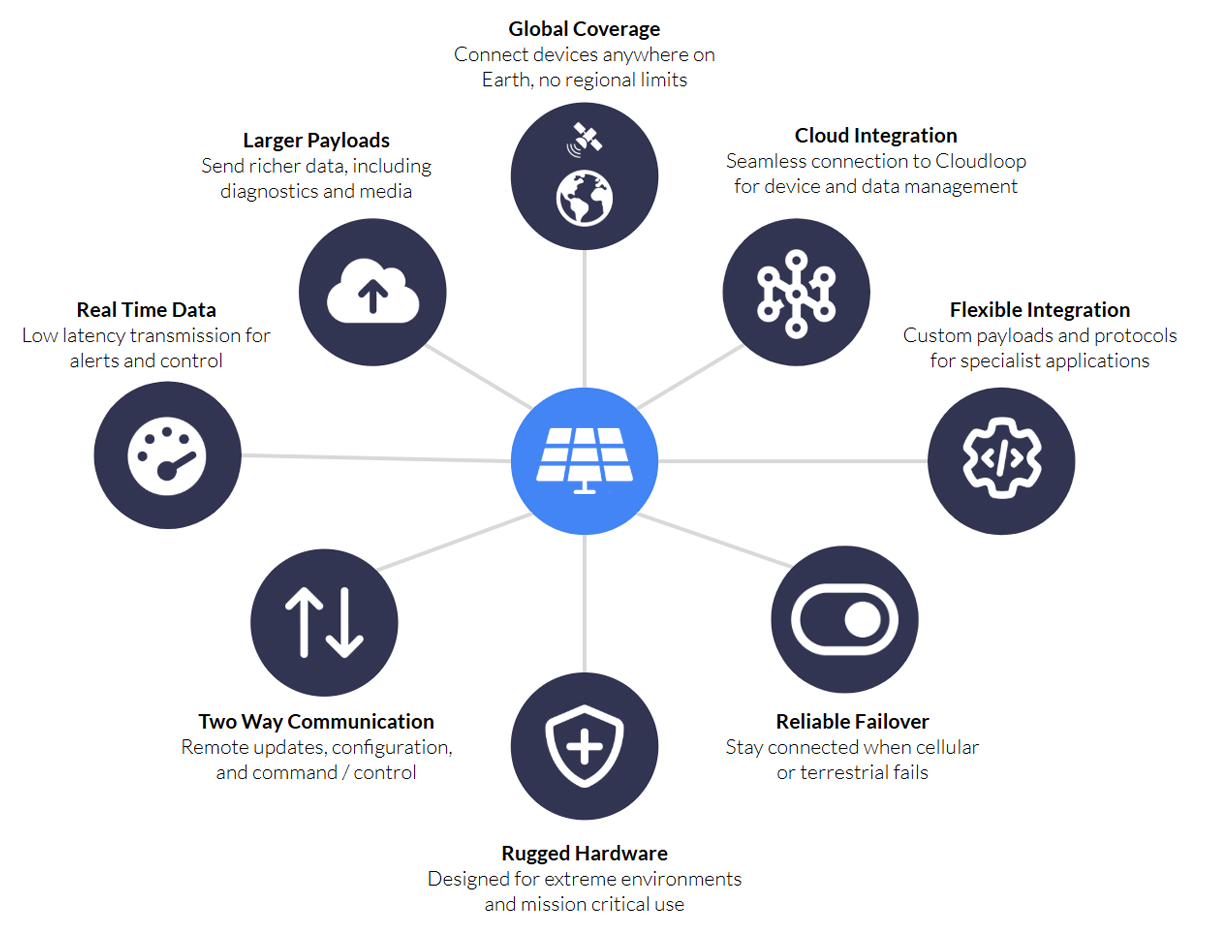

2. Interoperability Isn’t Automatic

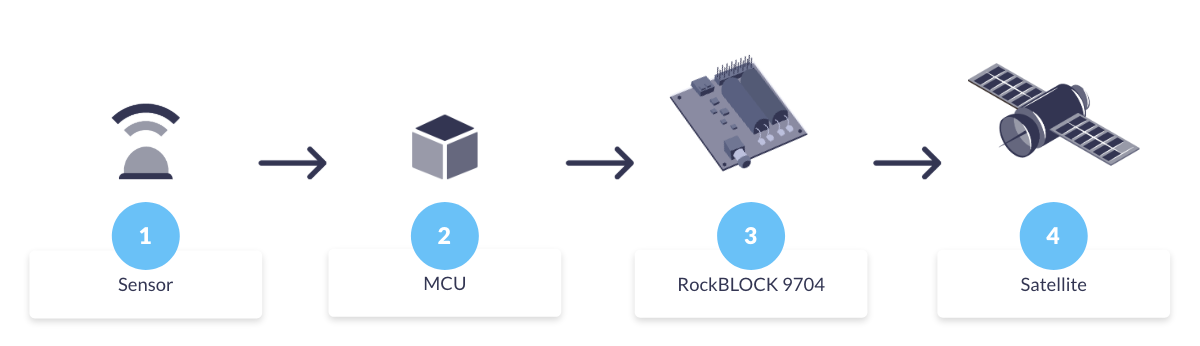

Remote IoT punishes cellular assumptions. The economics change when every transmission costs power, airtime, and often money.

This chapter shows how teams avoid brittle integrations by designing around constraints: a minimal payload strategy, a clear send policy, and ingestion built for compact messages.

Fast takeaway: prioritize purposeful messages and treat the translation layer as critical infrastructure – version it, test it, and monitor it.

3. The Field Will Prove You Wrong

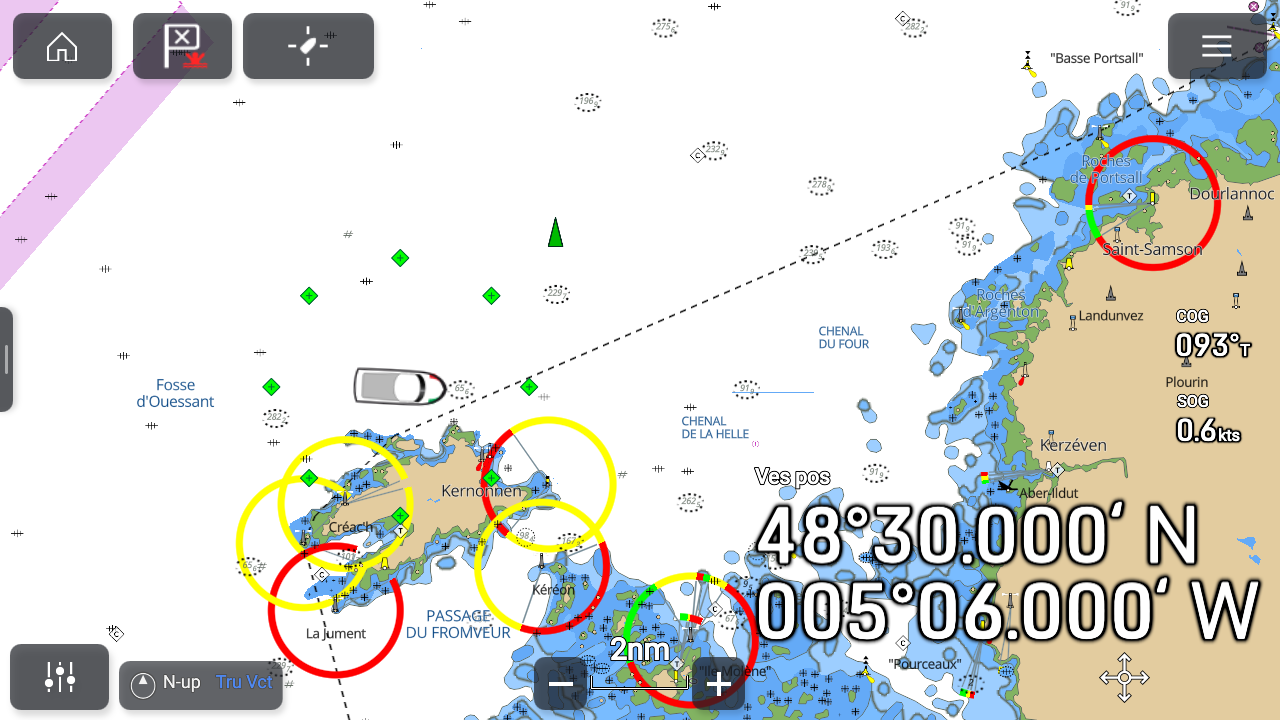

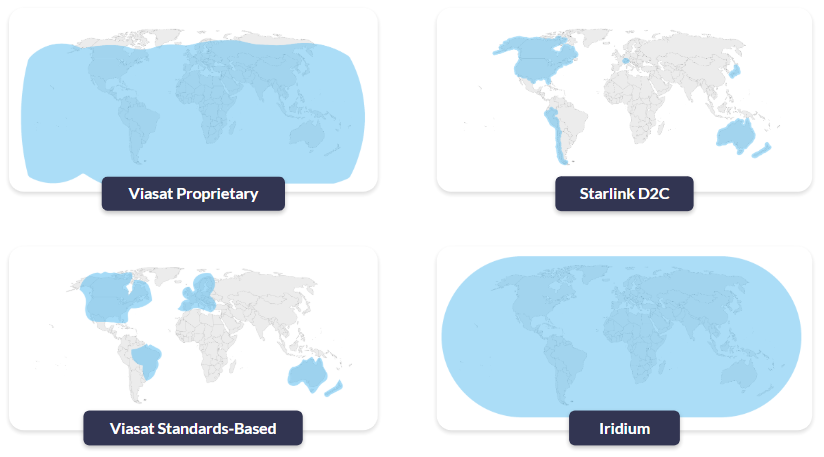

Coverage maps don’t guarantee performance. Antenna placement, terrain, structures, and foliage create real world RF failure modes.

The eBook clarifies the difference between ‘clear view of the sky’ (LEO satellites) and ‘line of sight’ (GEO satellites), and why confusing these leads to broken installs.

Fast takeaway: validate sky view at the true install height, and test in the actual environment before you scale.

4. Design For Delays, Not Perfection

Message-based satellite IoT doesn’t behave like web or cellular. Systems fail when they assume instant confirmation and tight timeouts.

This chapter explains the ‘accepted vs delivered’ distinction and why retries, buffering, and correct acknowledgements are foundational.

Fast takeaway: use jitter + backoff, implement store and forward properly, and only return ‘success’ after durable storage.

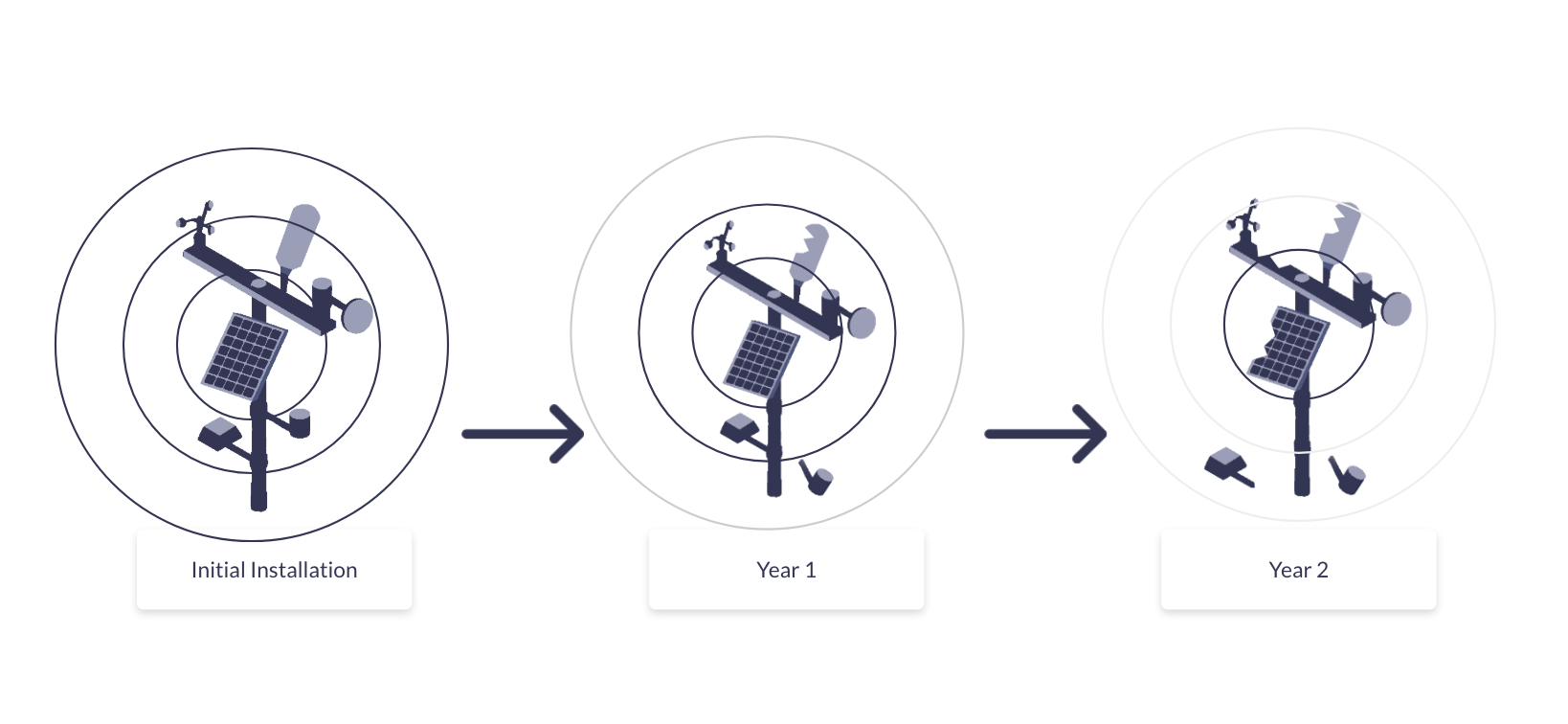

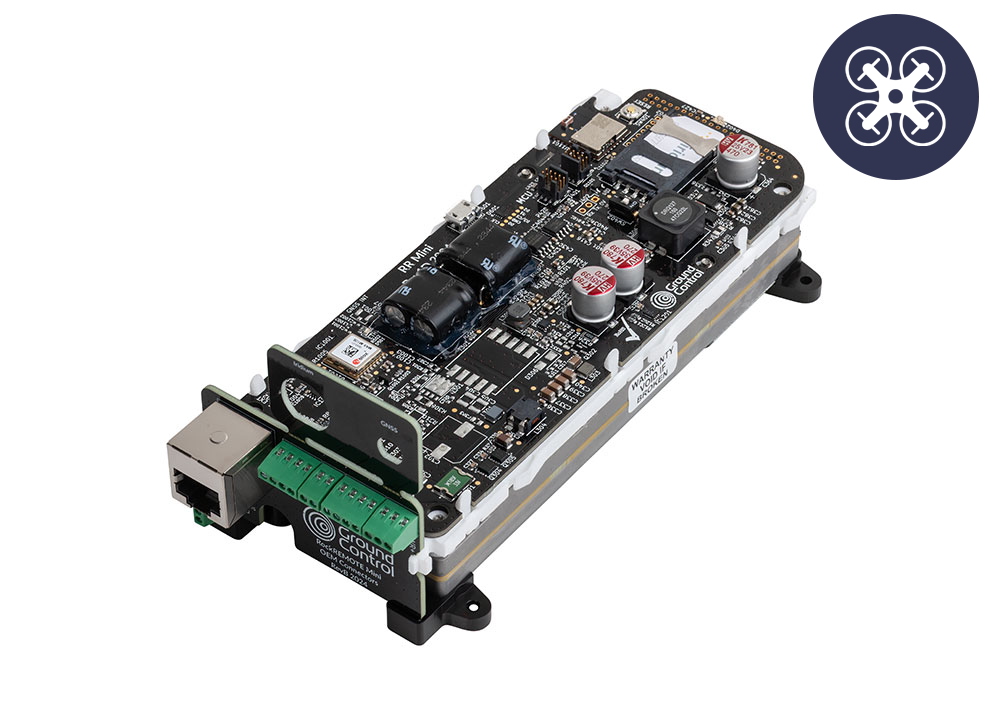

5. Lifecycle and Remote Device Management

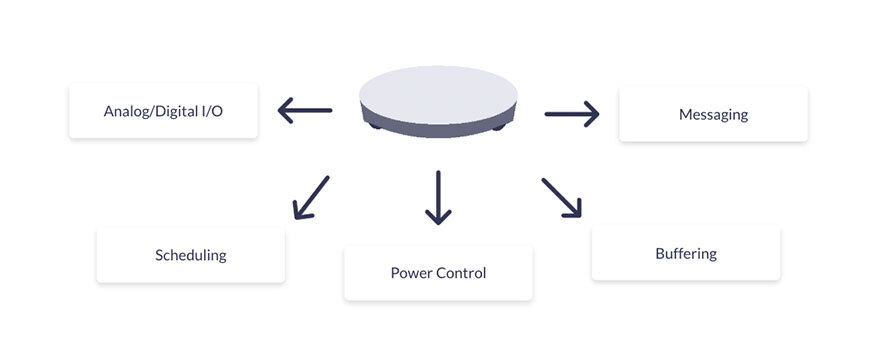

Remote device management traffic competes with mission data – reboots, logs, config reads, and updates all consume power and paid data.

The eBook covers how teams avoid slow-motion failures by separating ‘alive’ from ‘healthy’, controlling configuration drift, and planning staged updates.

Fast takeaway: treat configuration like code, budget for ops traffic, and design a real end of life workflow.

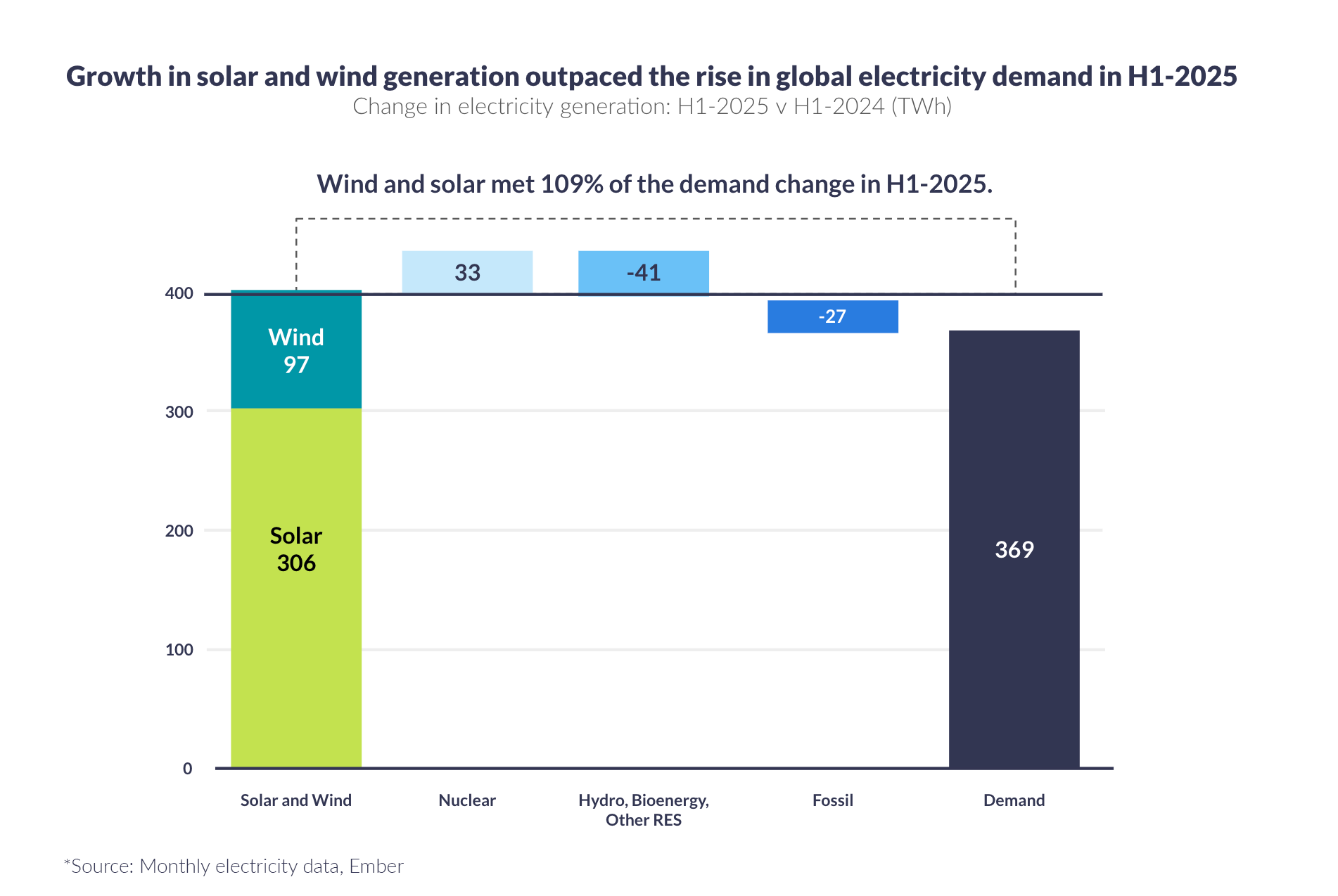

6. Data Discipline in Constrained Connectivity

Most systems can produce far more telemetry than anyone will ever use, and ‘send everything’ is the fastest way to lose control of battery life and budgets.

This chapter gives practical patterns like exception reporting, edge summaries, payload compaction, and ruthless prioritization so you protect what matters most.

Fast takeaway: define the smallest information set that drives decisions, then budget size/frequency/retry rules by priority tier.

Key Outcomes You Can Expect

By the end, you’ll be able to spot the integration choices most likely to cause schedule slip and rework, set realistic expectations for latency, delivery confirmation, and retries, and build payload and send policies that scale economically.

You’ll also learn how to reduce truck rolls by designing lifecycle management in from day one, and how to pressure test your deployment plan before you scale it.

The core theme throughout is simple: design for operations, not just installation.

Read the eBook before you make your next integration decision

Get the PDF immediately (ungated). It covers security handoffs, interoperability, field RF realities, latency/retries, device lifecycle, and data discipline.

Want help pressure testing your integration plan?

If you’re planning a remote deployment and want to validate your architecture, data budget, or rollout approach, we can help you identify risk early – before it becomes field rework.

FAQs

It’s written for remote deployments where constraints matter most – satellite and hybrid deployments in particular – but the integration lessons apply broadly to any system where latency, cost, power, and field access are real constraints.

Yes. Several chapters focus on operational issues that appear after launch (retries, lifecycle management, configuration drift, and data discipline).

Yes. Each chapter ends with concrete takeaways (e.g., security mapping and ownership, field testing non-negotiables, ‘slow link’ checklist, and data discipline checklist).

Have a remote IoT project to discuss?

No need to contact us to read the eBook – but if you want to chat about your remote IoT project, we’d love to hear what you’re working on.

Complete the form or email hello@groundcontrol.com with your application details, and we’ll connect you with one of our expert team to see if we can support your goals.