How Terrestrial Cellular Behaves in Remote Environments

Cellular connectivity performs well when coverage is stable and predictable. In those conditions, LTE-M and NB-IoT are often the most cost effective and operationally simple choice.

Challenges arise in remote environments where coverage quality fluctuates rather than failing completely. Field experience from utilities, water monitoring, and environmental telemetry deployments shows that link conditions at unattended sites often vary over time due to terrain, vegetation growth, weather, and seasonal effects, even when initial installation is successful.

From a power perspective, this variability matters. Under marginal coverage conditions, devices may attempt repeated attachment or transmission cycles before successful delivery. These retries consume energy without proportional data transfer.

Operationally, this can result in systems that appear functional but are difficult to predict. Batteries deplete faster than expected, and data gaps are harder to diagnose remotely. This does not mean cellular is unsuitable for remote monitoring. It highlights the importance of understanding how cellular behavior evolves within a specific deployment context, particularly at marginal coverage sites where energy risk can be as significant as coverage risk.

If your design needs predictable energy and diagnosability under uncertain RF, you may prefer a connectivity model that is explicitly scheduled and bounded: this is the key shift introduced by satellite IoT.

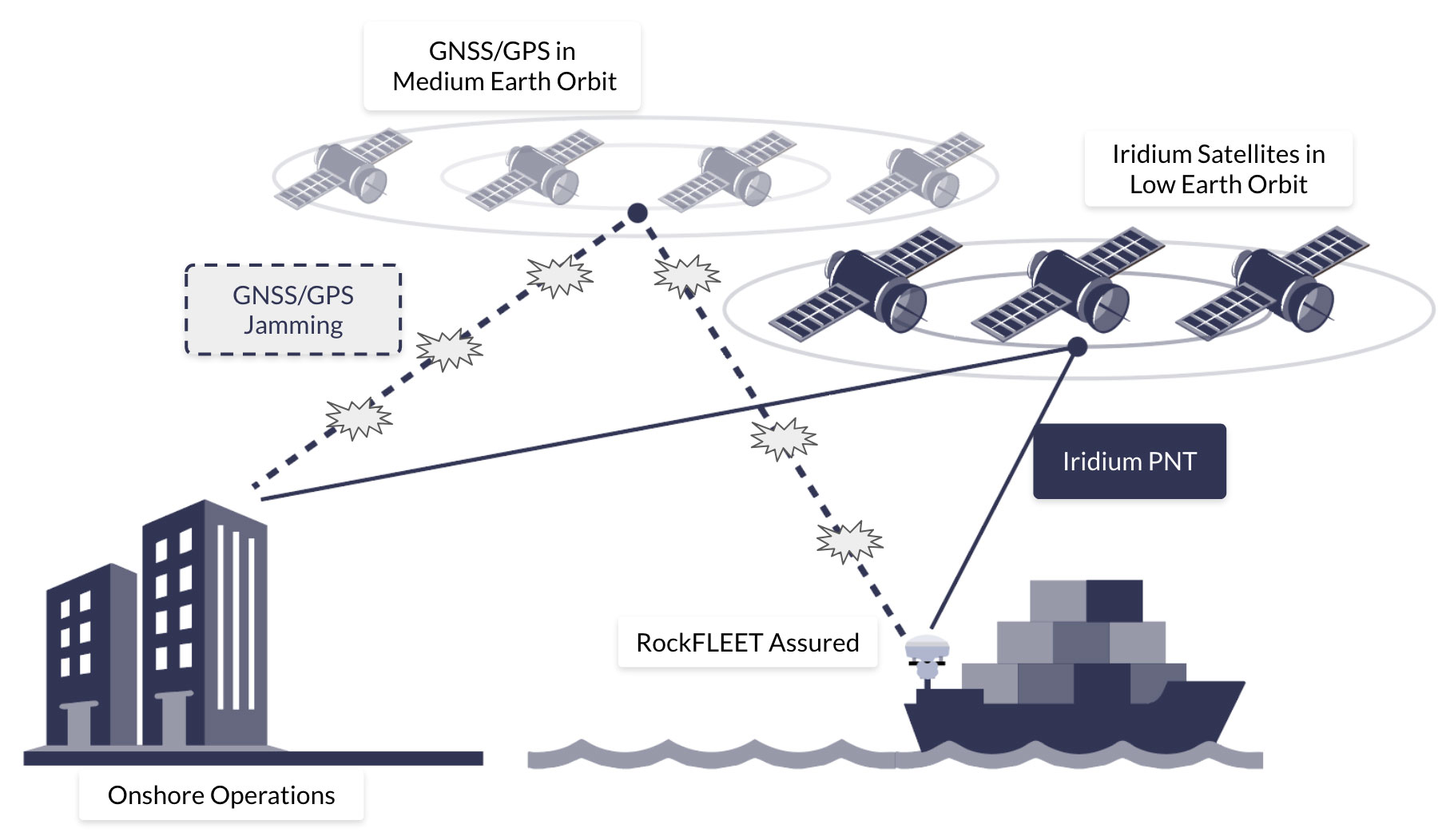

How Satellite IoT Architectures Change System Assumptions

Satellite IoT spans two broad architectural models: message-based services (store and forward / burst messaging) and IP-based services. Message-based links are naturally aligned to low duty cycles: devices wake on an application defined schedule to transmit a small payload, optionally open a short receive window, and then return to deep sleep. In this model there is no requirement for continuous “always-on” participation, and average energy use is closely coupled to reporting cadence, retry policy, and power domain design.

IP-based satellite terminals can provide richer connectivity and more interactive downlink, but may incur additional idle overhead to maintain readiness or session behavior, even when user traffic is low.

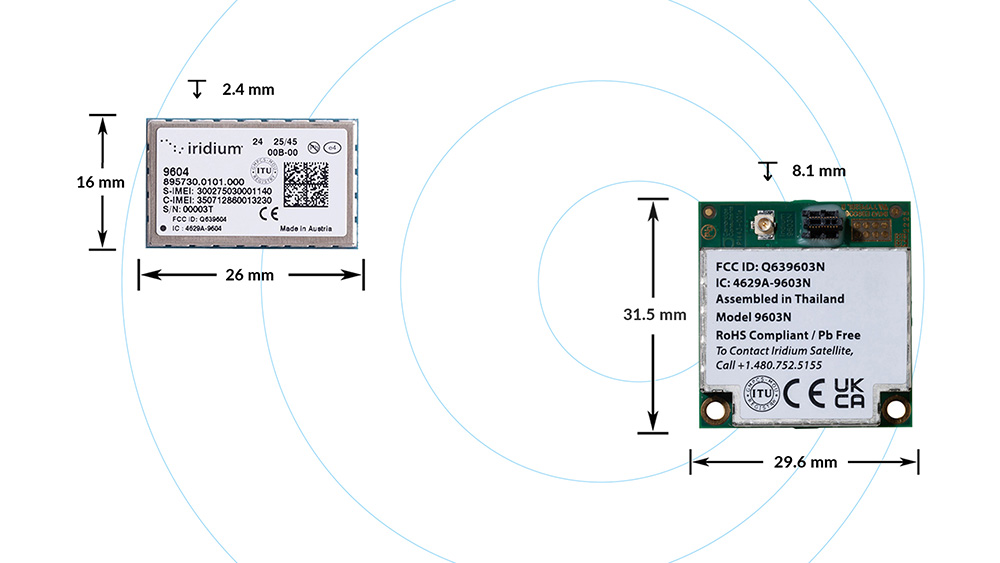

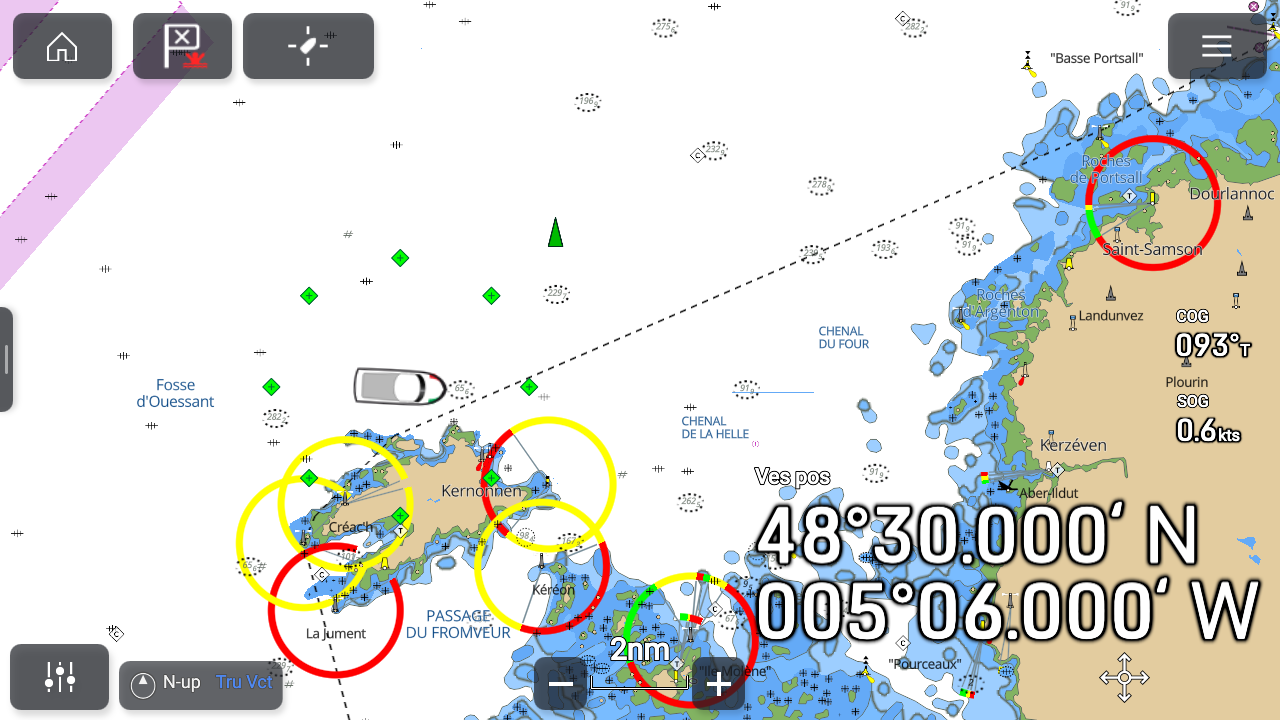

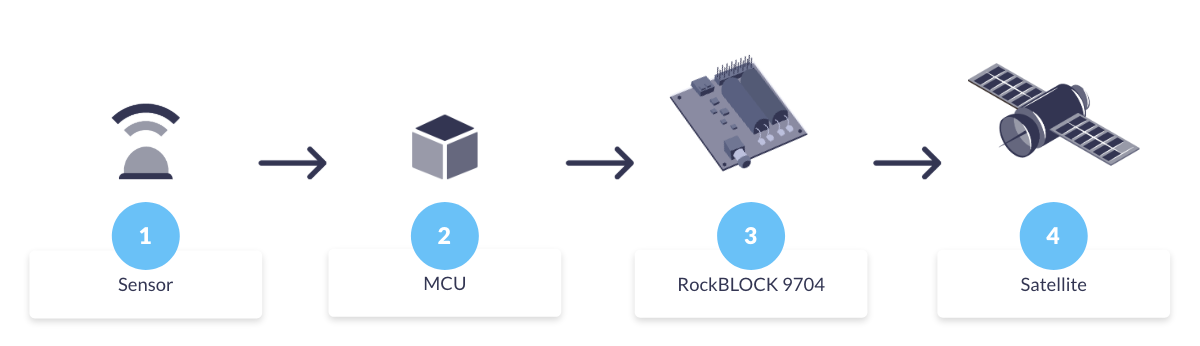

For long life environmental monitoring, the most defensible operating envelope is typically scheduled messaging with deep sleep between sessions, not continuous reachability. The remainder of this post therefore focuses on message-based satellite IoT, and on implementation patterns that make the comms link behave like any other managed subsystem with predictable states and budgets. We start with Iridium Messaging Transport (IMT) via RockBLOCK modules (particularly the 9704), as it fits naturally into a wake > transmit > sleep design.

Implementation path one: Message-based satcom as a managed subsystem (RockBLOCK 9704)

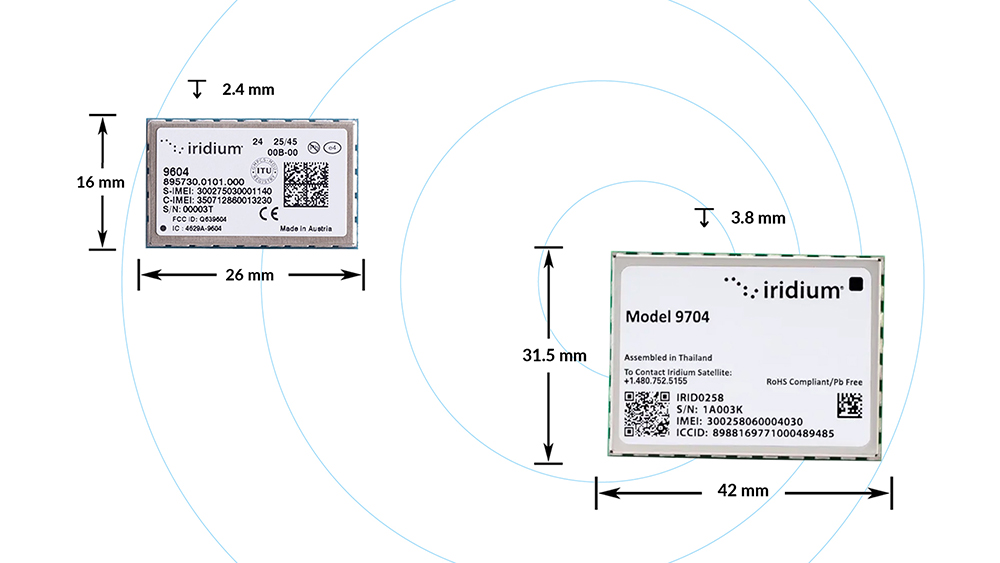

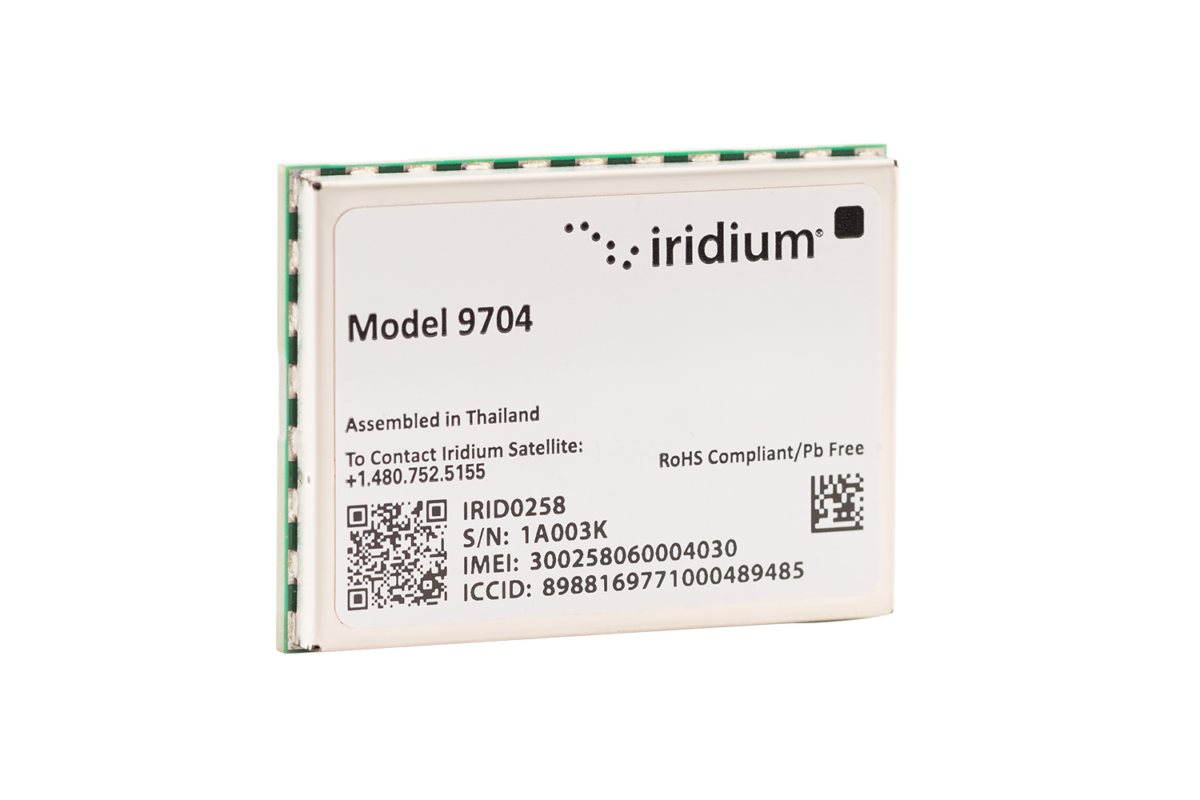

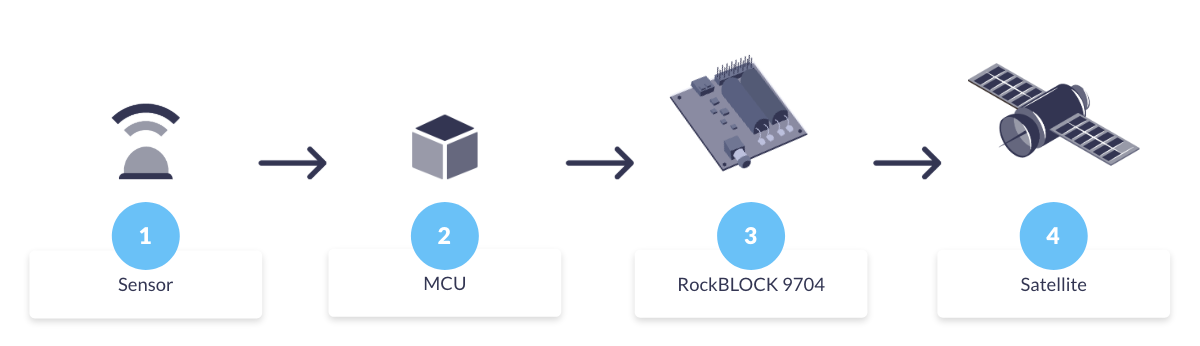

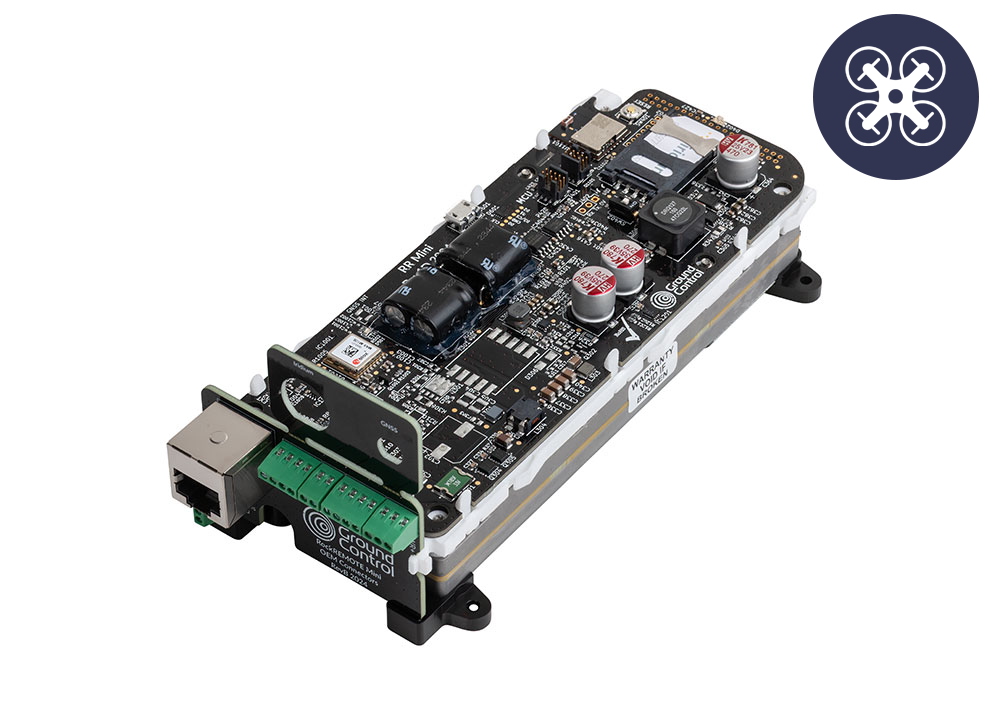

RockBLOCK 9704 is built around the Iridium Certus 9704 module and uses Iridium Messaging Transport (IMT): a cloud connected, two way messaging service for small to moderate payloads (up to ~100 KB) designed for IoT devices rather than continuous IP sessions.

In a long life monitoring node, it’s best treated as a schedulable subsystem inside a wider embedded design. In practice, integrators typically:

- Power-gate the modem (load switch/PMIC) so “off” is truly off

- Wake it only after sampling / validation, when there’s something worth sending

- Transmit in short, scheduled sessions, with an explicit retry policy

- Return to deep sleep (or fully unpowered) immediately after the exchange.

The key engineering advantage is boundedness: reporting cadence, session timing, and retry limits are largely under host control, so you can model energy around a small set of well defined states (off / boot / transmit / receive window).

Peak transmit current can be high because closing a link to a LEO constellation requires substantial instantaneous RF power. In a messaging oriented design this draw occurs in short, intentional transmit bursts with bounded duration. The design trade shifts from minimising peak current to ensuring the power system comfortably supports short peaks (battery internal resistance, regulator headroom, local capacitance), while keeping average energy dominated by how often you transmit.

RockBLOCK 9704 doesn’t manage your sensor rails or MCU sleep states – those remain the job of the embedded design – so standard low power techniques (switched sensor rails, unpowered analog front ends outside measurement windows) still apply.

Because IMT is a two way messaging service, you can make delivery outcomes explicit at the application layer: buffer locally, send, then check for confirmation on the next scheduled wake window, without keeping the node awake. This keeps reliability mechanisms aligned with the same duty cycled philosophy as sensing. The important caveat is that network availability (constellation / service uptime) is not the same as guaranteed delivery in every installation: local RF conditions still dominate, i.e. sky view, canopy, terrain, enclosure losses, and antenna placement.

That integration pattern works well when you’re building your own node around a messaging modem. When you’d rather avoid custom hardware and firmware integration, the same principles can be applied at the system level:

Implementation path two: RockBLOCK RTU as an integrated low power monitoring device

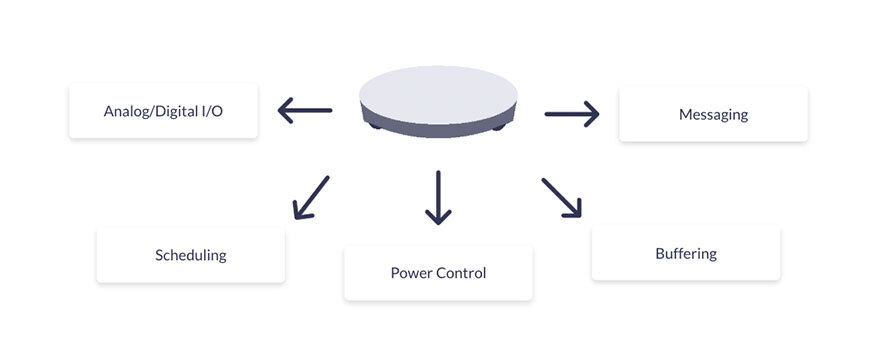

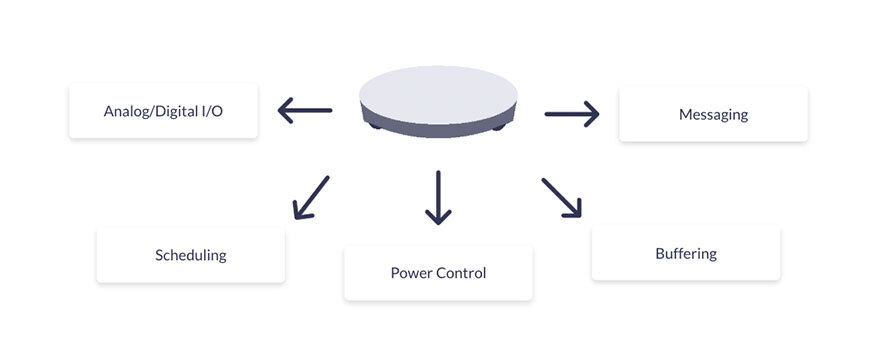

If you don’t want to integrate and power manage a satcom module inside your own node, RockBLOCK RTU packages the same sleep dominant principles at the system level: sensing, scheduling, local buffering, and messaging in one device. RockBLOCK RTU uses Iridium Short Burst Data (SBD), Iridium’s classic two way short-packet messaging service, so it naturally fits duty cycled environmental monitoring workloads.

RockBLOCK RTU is designed around a sleep dominant lifecycle:

- Extended low power sleep as the default state

- Wake events driven by schedule, thresholds, or external triggers

- Short transmission windows

- Immediate return to sleep.

Sensor power is explicitly controlled so sensors are energised only during measurement windows, eliminating standing analog bias currents. This mirrors best practice low power sensor design without requiring custom analog switching. Because message-based satellite operation can be scheduled without continuous reachability, RockBLOCK RTU avoids some of the standing ‘network-reachable’ overhead that can appear in terrestrial designs (depending on configuration and coverage).

In addition to sensing, RockBLOCK RTU provides system level control and observability that are often important in unattended deployments. Configurable digital outputs can switch sensor power rails or external loads, and analog inputs can monitor system voltages (battery, supply rails, excitation lines).

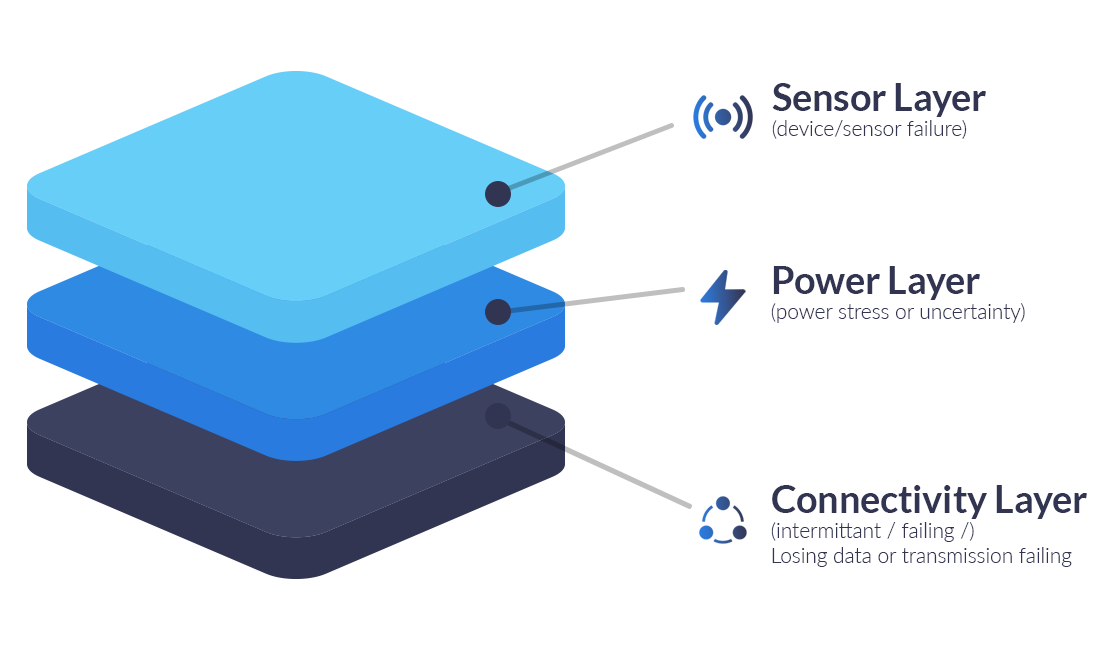

This enables remote verification of power health, detection of brownout conditions, and confirmation that sensors are energised only when expected, helping distinguish sensing issues, power delivery problems, and comms failures without site access.

Time Alignment and Operational Visibility

A recurring operational challenge in unattended monitoring is ambiguity: when data is missing, it’s often unclear whether the system failed to measure or failed to report. RockBLOCK RTU reduces this ambiguity with an internal clock and UTC-aligned timestamps (GNSS when available), making it easier to correlate measurements with expected reporting intervals and separate sensing gaps from delivery failures.

When Proprietary Messaging Satcom is Usually the Wrong Tool

Message-based proprietary satellite IoT is optimized for predictable, low duty telemetry – not high volume data or near real time streaming. Where cellular coverage is stable and power is plentiful, terrestrial LPWAN/cellular often remains the simplest and most cost effective option.

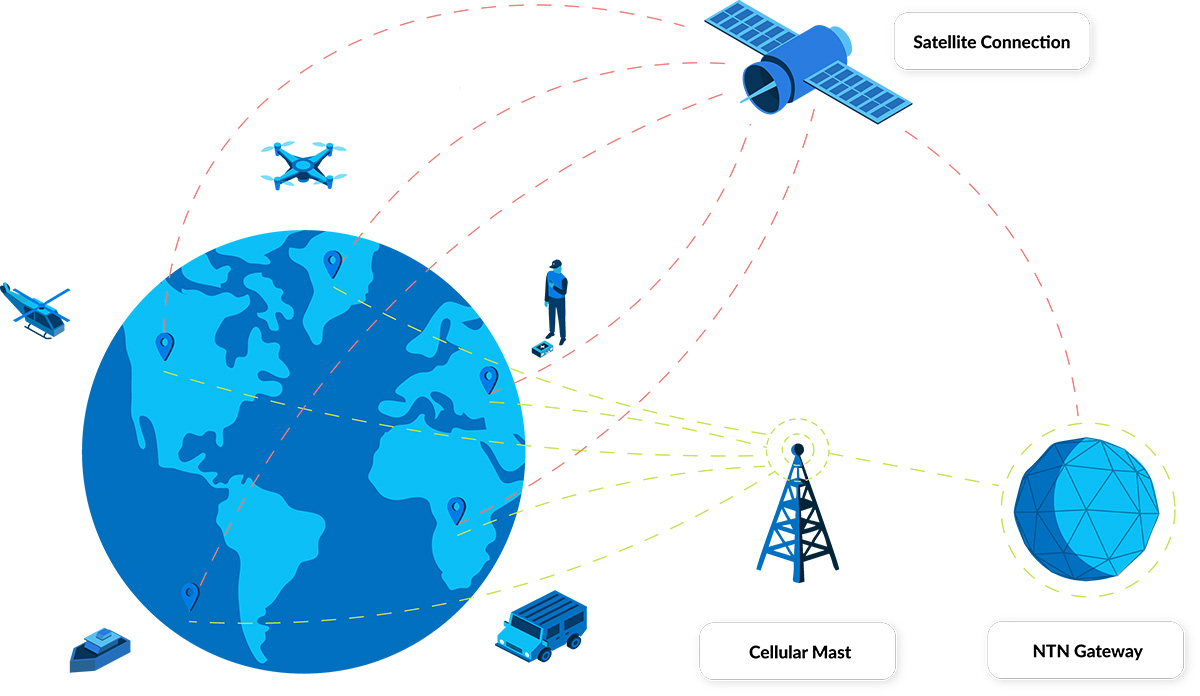

The interesting middle ground is NTN NB-IoT, which aims to extend cellular-style connectivity via satellite, so it’s worth understanding how much of the terrestrial behavior (and variability) it inherits.