The Utilities sector is in the midst of rapid change. Humans are consuming more energy than ever before, so much so, that the International Energy Agency expects global energy demand to increase by 37% by 2040. Utilities companies are increasing production and distribution capacity to fulfil consumer supply, while navigating a surge in demand for advanced technology, electric mobility and smart cities.

Concurrently, Utility providers are facing a number of challenges, including: ageing infrastructure, climate change and cybersecurity. All of which threaten supply and providers’ ability to cope with increased demand.

To better enable energy providers to respond to this changing, increasing demand, Ground Control surveyed 1,250 Utilities customers based in the UK and the US. We asked consumers direct questions about what they view as some of the largest risks to their energy supply and what would prompt them to change suppliers. Moreover, respondents were surveyed in groups, with some participating in early February, and others in early March. The impact of Russia’s invasion of Ukraine upon consumer outlook is significant, and something Utilities companies really should be aware of. We hope this insight will empower Utility providers to make decisions better aligned with consumer priorities and concerns.

The consumer view of the current Utilities landscape

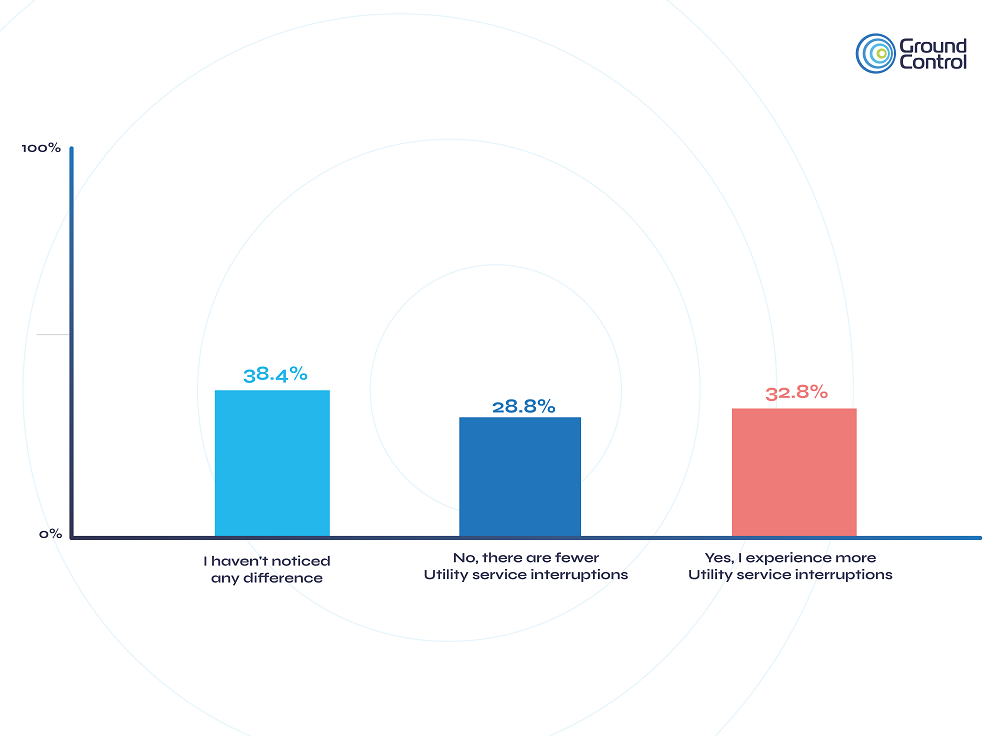

In comparison to 10 years ago, do consumers feel there has been more service interruptions today?

Overall, survey results show that around a third of recipients (32.8%), feel they experience more service interruptions (outages) now, than they did 10 years ago. 28.8% reported fewer Utility service interruptions, and the majority (38.4%), responded to say they hadn’t noticed a difference. Interestingly, UK survey participants were more likely than their US counterparts to respond saying they felt the number of Utility service interruptions had increased, at 35.5% vs 30.2%.

When you consider the number of US power outages in comparison to those in Western Europe, the above is quite surprising. The US government has reported that the average American can expect to lose power for an average of five and a half hours in 2022 and in Western Europe this figure is just once per year, for a lower average of 58 minutes.

There was very little difference when comparing groups who were surveyed in February, to those surveyed in March. With just a slight increase from 32.8% to 34.3% of respondents reporting they felt there has been an increase in the number of Utility interruptions.

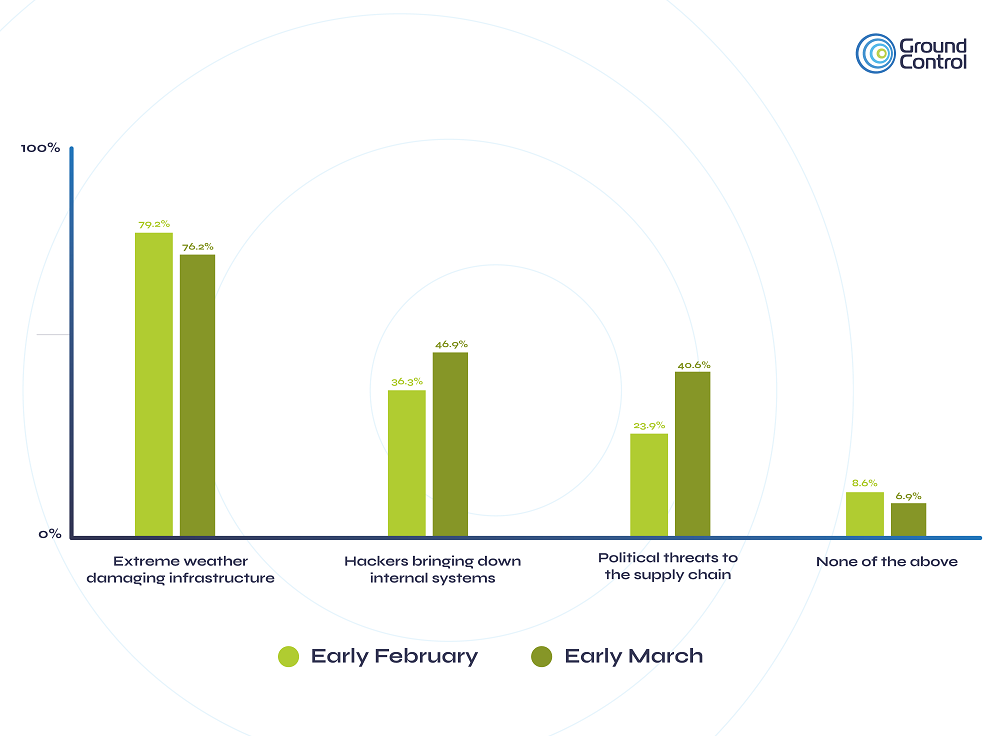

What do consumers view as a threat to their Utilities supply?

As illustrated above, the majority of consumers (79.2%) surveyed in early February indicated that extreme weather damaging infrastructure was a threat to supply. And a very similar figure of 76.16%, was reported by those surveyed in March. Comparatively, hackers bringing down internal systems (as was done in the Colonial pipeline attack), was selected by 36.3% of those in February, and 46.9% in March. Given that almost half (46.7%) of March’s survey respondents stated they believed there was a slightly higher cybersecurity risk to Utility supply due to the war in Ukraine, and 20.3%, a substantially increased risk, this 10% increase is significant.

Similarly, the number of respondents indicating that they viewed political threats as a risk to the Utility supply chain almost doubled when comparing the February and March survey groups (23.9% vs 40.6%). Again, this is particularly noteworthy as 44.1% of respondents surveyed in March, stated they felt the political risk to Utility supply had slightly increased as a result of the war in Ukraine, and nearly one third (31.3%), that this risk had increased substantially.

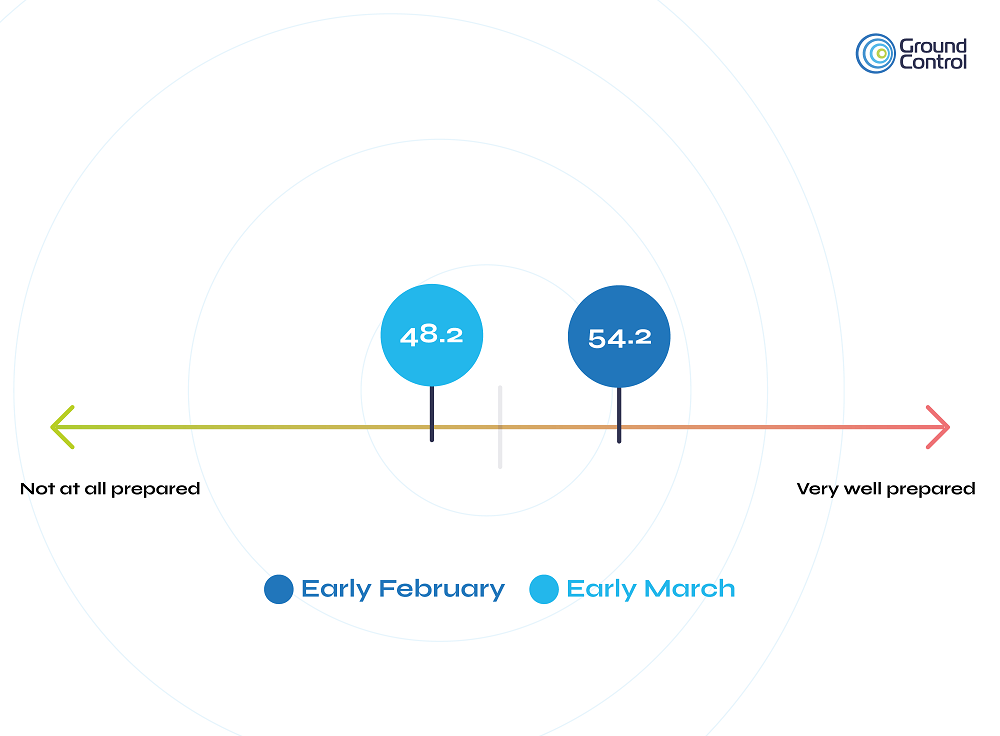

Do consumers feel Utility providers are well prepared to manage current risks?

Consumers were asked to indicate on a scale from 0 – 100, how prepared they felt their Utility suppliers were able to manage previously mentioned risks. As can be seen in the above graph, those surveyed in early February responded with an average of 54.21. In contrast, consumers who were surveyed in early March, reported an average of 48.21.

This reduction in confidence is arguably due to consumers becoming more aware of the risks to supply, as a result of the war. Which is certainly understandable, given Europe’s dependence on Russian supplies of natural gas and ongoing sanctions of Russian oil.

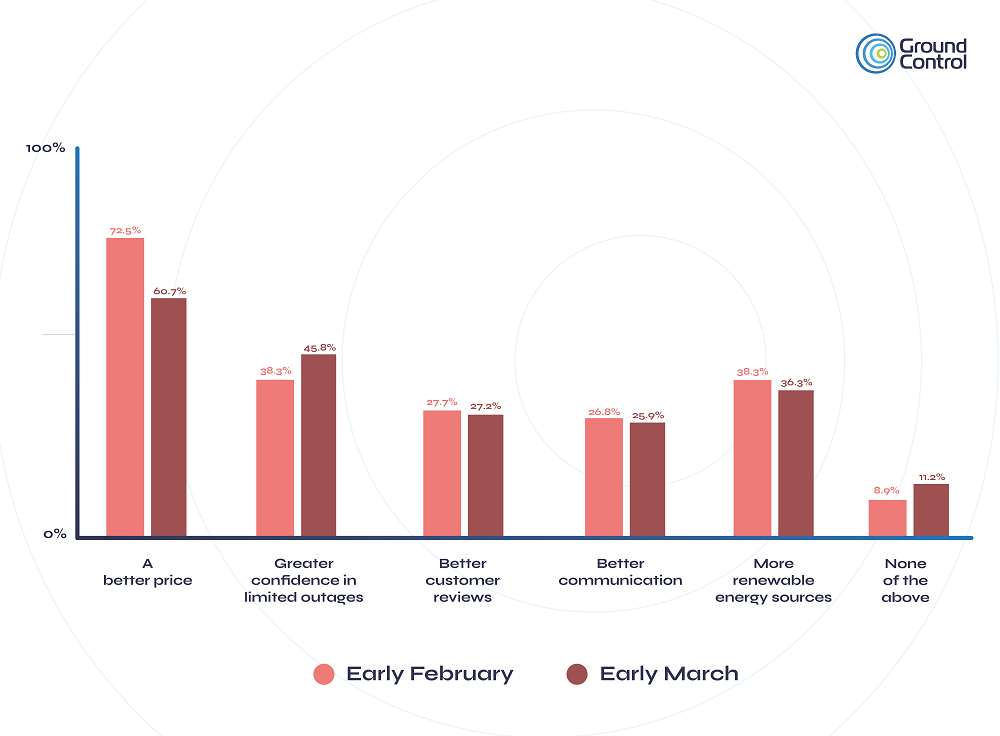

What would prompt customers to change Utility suppliers?

As you might expect, nearly three quarters (72.5%) of survey recipients stated a better price would prompt them to change Utility supplier. However, in March’s survey group responses, this decreased to 60.7%, and greater confidence to limit outages rose from 38.3% to 45.8% comparatively. Which suggests that following the events of the war, customers have become marginally less price sensitive and place a higher priority on steady Utility supply.

Consumers reporting more renewable energy sources, a potential reason to change Utility suppliers, stayed relatively stable across both survey groups at 38.3% and 36.3%. Likewise, 27.8% and 27.2% of each group respectively, stated better customer reviews may prompt them to change energy providers.

Finally, just over a quarter of recipients for both the February (26.7%) and March (25.9%) groups reported better communication as a potential prompt to switch providers. The fact that this figure has remained steady implies that simply improving communications with customers may not be enough to restore the pre-war confidence consumers held with regards to Utility companies ability to manage risks to supply.

In summary, the survey highlights that consumers are relatively clued up on the challenges facing the Utilities industry and that the war has impacted concerns regarding Utility supply.

So, what can Utility providers do?

All Utility suppliers and energy network operators must strive to develop intelligent solutions and energy efficient operations, while ensuring secure infrastructure for the environment today and in the future. Ultimately, the key to success in Utilities is to collect accurate, real-time data from infrastructure and assets, at every point in the supply chain – from networks, plants, to treatment environments and customers. Many companies are already ramping up their development of IoT solutions in order to help them cope with the strain on energy demand. However there are connectivity linkages to each of the previously mentioned challenges of: ageing infrastructure, cybersecurity and climate change.

Why is connectivity so important in the Utilities sector?

Energy providers need to be able to determine the most efficient way to distribute Utility supply while also minimising waste, and distribution is what makes SCADA special. The orchestration of power, water and gas loads, all being reliably routed, monitored and controlled to deliver these resources. This is the centre of the critical infrastructure for every Utility company; and for this to take place, frequent, accurate, reliable data from all sites is required.

TSAT – Ubiquitous connectivity for energy providers

The TSAT satellite system is specifically designed to meet the demanding requirements of the SCADA and Utility industries. TSAT provides a private satellite network operating a direct communication channel between a process control centre and remote locations.

TSAT’s unique private satellite network solution features an industry leading mini VSAT hub that is specifically engineered to support mission critical applications (SCADA / Telemetry) in the energy and utility markets. The ruggedized and utility toughened-hardware is designed to provide years of reliable operation in remote locations and harsh environments.

Interest piqued?

To learn more about how SCADASat / TSAT can be used as a connectivity and security solution for the Utilities sector, download and read our eBook. Our advice covers the key issues facing utilities and renewables organisations today, and how the adoption and installation of secure satellite technology services can provide an effective line of defence in the event of a cyber threat while reducing costs, and improving operational efficiency.

Our expert team has delivered reliable, secure data transmission solutions to the Utilities sector for 20 years. If you’d like to get in touch, simply email hello@groundcontrol.com or phone us on +44 (0) 1452 751940

If you’re interested in learning more about TSAT and it’s role in unlocking ubiquitous connectivity, take at our related content: SCADASat | TSAT case study – Garth Wind Shetland Islands Scotland | Powering tomorrow: challenges and opportunities in Utilities

Get in touch